Massive buyers in One 97 Communications, which operates virtual funds primary Paytm, together with Masayoshi Son’s SoftBank and China’s Ant Staff, an associate of Alibaba, have mentioned promoting stocks within the corporate via a secondary inventory deal, a couple of other people within the know of the topic stated.

Those shareholders and the funding banks representing them had previous approached telecoms billionaire Sunil Mittal of Bharti Enterprises and every other Indian conglomerate with an be offering to shop for their stakes.

However those talks didn’t make a lot headway and Bharti isn’t these days engaged in conversations in this factor, stated those other people at the situation of anonymity.

Paytm’s control together with its founder and CEO Vijay Shekhar Sharma are observed to be adverse to a strategic investor approaching board the corporate.

A secondary sale to monetary buyers within the open marketplace via a block deal is, on the other hand, nonetheless a chance, two other people conversant in the hot trends stated.

Ant and SoftBank are prone to offload stocks regularly out there as a part of their plan to go out Paytm, other people within the know stated.

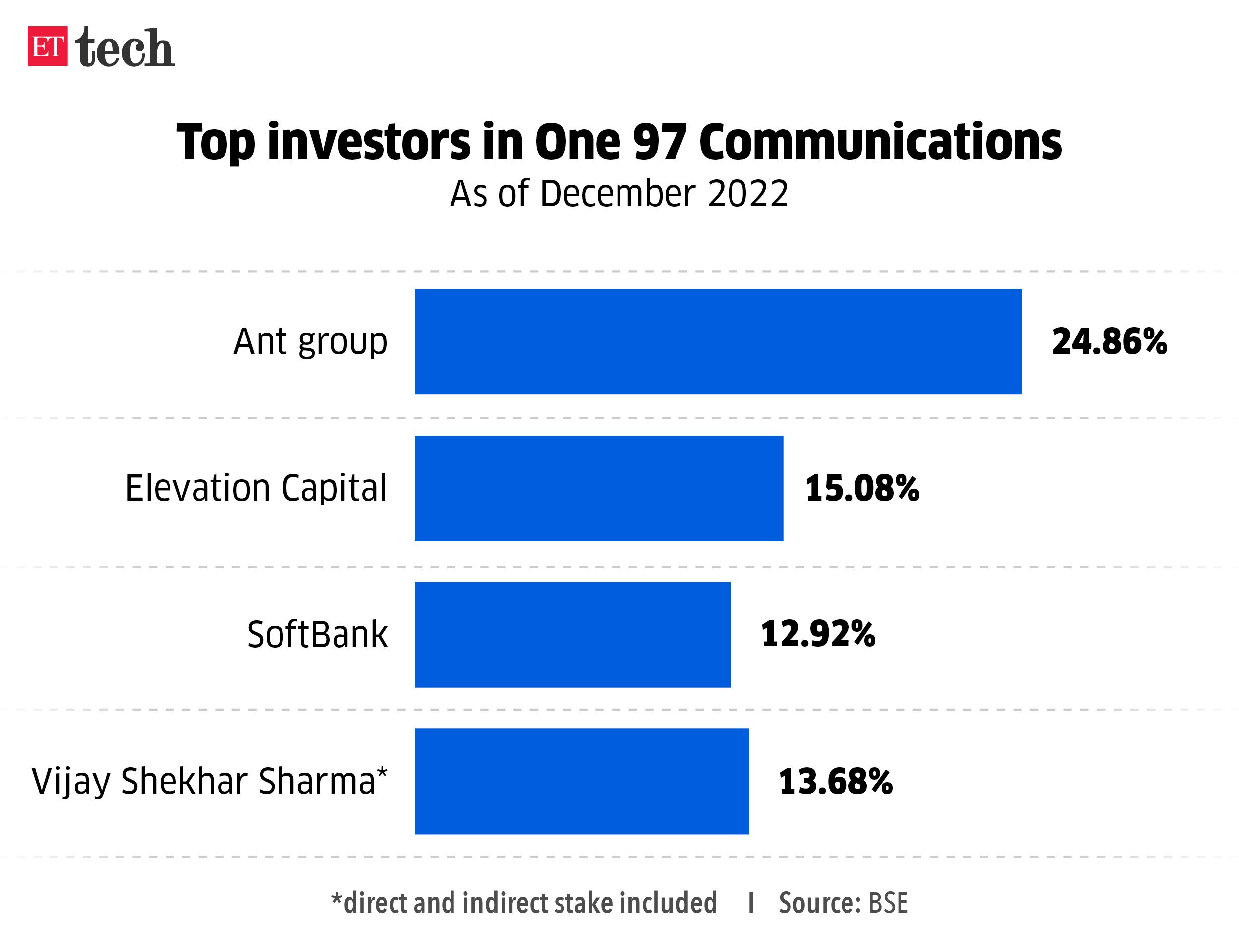

Jack Ma- based Alibaba had exited the web funds primary just lately however Ant organization (previously Ant Monetary) continues to be the one greatest shareholder within the agency with about 25% stake. SoftBank and Elevation Capital personal round 13% and 15% respectively, within the Noida-based agency. Sharma, himself holds as regards to 14% within the corporate. One97’s shareholding trend will most probably trade as the corporate done a proportion buyback price Rs 849.83 crore at a mean value of Rs 545.93 in line with proportion on February 13.

A file by way of analysis agency Macquarie in November closing yr had stated Paytm could be in danger after Reliance Industries introduced it might spin off and record its monetary services and products unit to have a much wider play within the client going through industry. Veteran banker and previous ICICI Financial institution leader KV Kamath, has been named because the chairperson of Reliance Jio Monetary Services and products.

“RIL has demonstrated its starvation for achieving scale prior to now in different companies, and in our view, can pose an important enlargement and market-share chance for gamers like Bajaj Finance and Paytm with whom it might be competing head-on,” the Macquarie file stated closing yr.

Bloomberg on Friday reported that Indian telecommunications rich person Mittal used to be in the hunt for a stake in Paytm by way of merging his monetary services and products unit into the fintech large’s funds financial institution, consistent with other people with wisdom of the topic.

An individual conversant in Bharti’s considering on the other hand stated those talks aren’t on “This isn’t in play,” he stated.

When contacted by way of ET, a Paytm spokesperson stated, “We don’t touch upon speculations, on the other hand, we will verify that our center of attention stays on construction a sustainable and winning industry for the longer term and developing price for all our stakeholders. We aren’t concerned with this kind of discussions,” stated in an emailed commentary.

A spokesperson for Bharti Enterprises stated on Friday, that the corporate does not touch upon marketplace hypothesis.

SoftBank, Elevation Capital, and Ant organization, didn’t reply to ET’s emailed question until press time.

The Ant organization has been one of the vital greatest backers of Paytm since Alibaba’s funding within the agency. Its stake inched up upper than the brink of 25% because of a just lately concluded buyback at Paytm. This has additionally intended that Ant is having a look to carry its possession to underneath 25% for regulatory functions as Paytm is a professionally controlled corporate. Bloomberg reported this construction on Saturday.

Just lately, Alibaba organization bought a three.1% stake in One97 Communications in the course of the open marketplace and mopped Rs 1,377 crore. The Chinese language agency has been offloading stakes in indexed new-age generation firms in India amid a pointy erosion within the price of its investments and total geopolitical issues between the 2 nations. The Chinese language multinational had offloaded a three% stake in on-line meals supply aggregator Zomato previous in November. Douglas Feagin, an Ant organization nominee on Paytm board, resigned on February 3. He used to be a non-executive, non-independent director.

The conversations across the broader secondary proportion sale at One97 Communications, on the other hand, aren’t associated with the regulatory facet of Ant keeping up less than 25% shareholding in Paytm, other people within the know stated.

SoftBank too has been liquidating its place as it’s been critically hit by way of the turbulence in tech valuations particularly within the public markets globally. After Paytm’s IPO in November 2021, SoftBank bought about 4.5% in Paytm for approximately $200 million.

Paytm stocks have dropped over 71% since its inventory marketplace debut 15 months in the past. The corporate in its newest income name stated it has progressed margins and after all hit running profitability within the December quarter of economic yr 2023.

The easier than anticipated effects has helped the inventory achieve momentum at the bourses since saying the income previous this month. On February 24, Paytm’s scrip closed at Rs 623.25 in line with proportion on the finish of industry at the Bombay Inventory Trade.

Throughout the December quarter, Paytm reported a favorable EBITDA ahead of Esop price (income ahead of hobby, taxes, depreciation, amortisation and worker inventory possibility prices) of Rs 31 crore.

In a post-earnings name with analysts, Paytm president and organization CFO Madhur Deora had stated this used to be sustainable.

Supply Through https://retail.economictimes.indiatimes.com/information/e-commerce/e-tailing/softbank-ant-group-discuss-paytm-secondary-sale-to-reduce-holding-in-payments-firm/98261022